Latest Updates

Due dates for filing of Form GSTR-3B for the Tax Periods from October, 2020 till March, 2021

Government of India, Ministry of Finance (Department of Revenue), CBIC, vide Notification No. 82/2020 – Central Tax, dated 11th Nov., 2020, has added sub rule (6) to Rule 61 of the Central Goods and Services Tax Rules, 2017, to prov....

Date: 17 Dec, 2020

Category: All Business Men

Checklist to Avoid Mistakes in Filing ITR 7 for AY 2020-21

please click on website link for more details ....

Date: 16 Dec, 2020

Category: Service Organisations/NGOs

One time relaxation to update UDIN

A One time relaxation to update UDIN has been enabled. Kindly update the UDIN before 31st December, 2020 of audit report/certificates to avoid invalidation ....

Date: 14 Dec, 2020

Category: All Business Men

Extension time limit for completion or compliance of any action, by any authority or by any person, has been specified

(i) where, any time limit for completion or compliance of any action, by any authority or by any person, has been specified in, or prescribed or notified under the said Act, which falls during the period from the 20th day of March, 2020 to the 2....

Date: 14 Dec, 2020

Category: All Business Men

ONLINE APPLICATION BY TAXPAYERS FOR UNBLOCKING E-WAY BILL GENERATION FACILITY

1. 1. From 1st December, 2020, onwards, the EWB generation facility is being blocked for all taxpayers, irrespective of their Aggregate Annual Turnover, for default in filing of Return in FROM GSTR-3B or statement in FRO....

Date: 12 Dec, 2020

Category: All Business Men

FAQs on quoting of UDIN

CLICK ON WEBSITE LINK FOR MORE DETAILS ....

Date: 08 Dec, 2020

Category: All Business Men

Vivad se vishwas scheme

Clarification on Vivad Se vishwas given in PDF Click on Website Link ....

Date: 04 Dec, 2020

Category: All

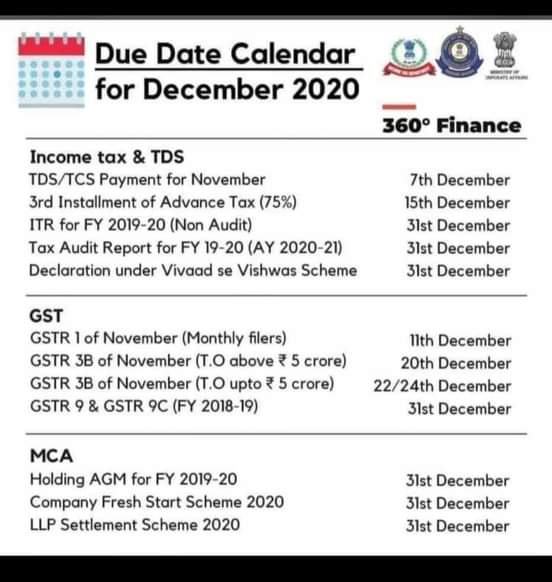

Due dates for December, 2020

Due Dates for Income Tax, GST, MCA In December, 2020 ....

Date: 01 Dec, 2020

Category: All

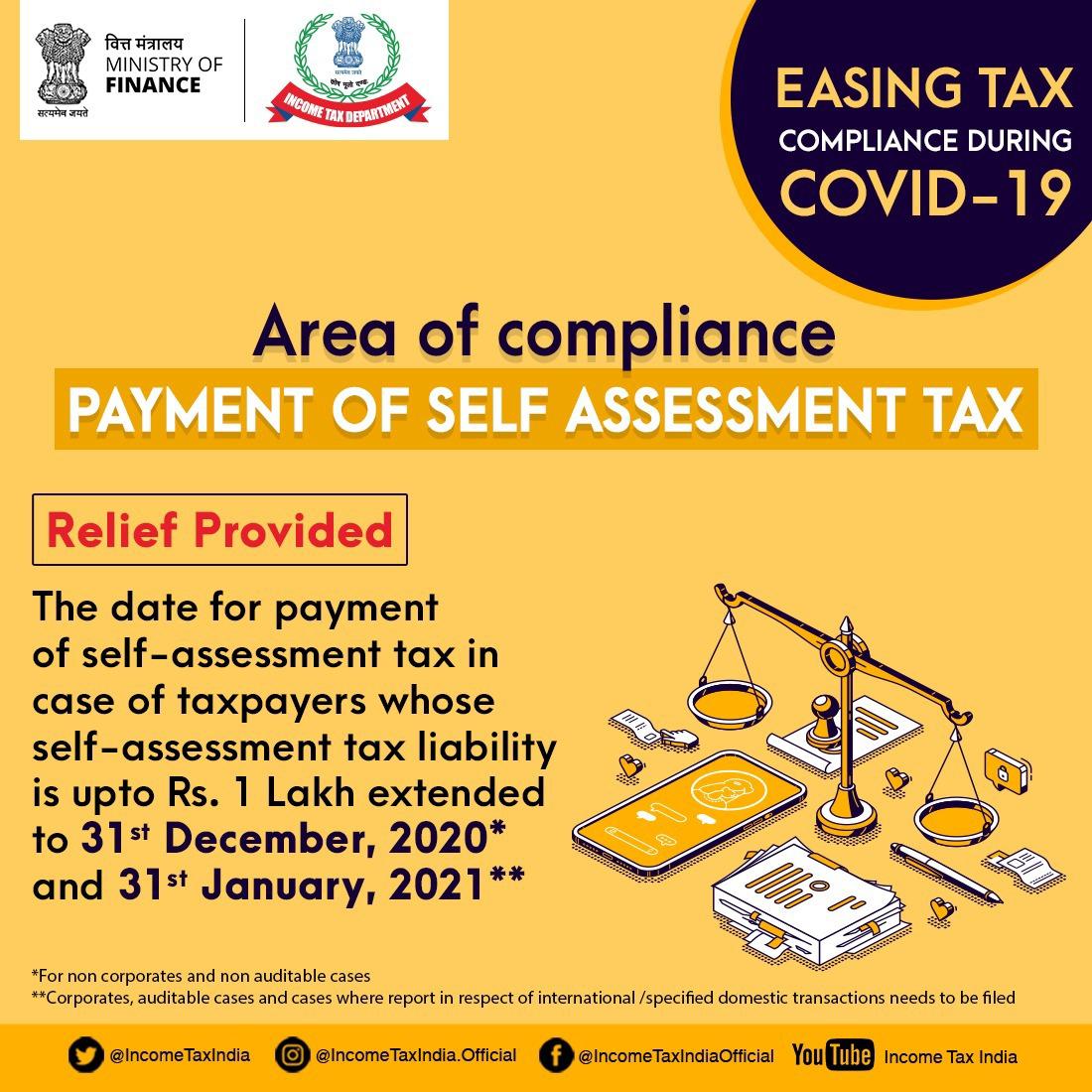

PAYMENT OF SELF ASSESSMENT TAX - RELIEF PROVIDED

The date for payment of self - assessment tax in case of taxpayers whose self - assessment tax liability is upto Rs. 1 Lakh extended to 31st Decem ber, 2020* and 31 st January 2021** *For non corporates and non auditable cases **Corp....

Date: 01 Dec, 2020

Category: All

_.png)